When I present trainings and workshops I always get at least one question I can’t answer on the spot and need to look up. Here are the Questions and Answers from the week of January 12th, 2009:

When I present trainings and workshops I always get at least one question I can’t answer on the spot and need to look up. Here are the Questions and Answers from the week of January 12th, 2009:

-

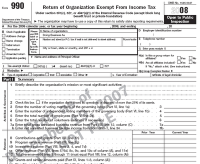

If our organization awards scholarships do we list that on the form 990?

Yes you probably do. For information about what kinds of grants and other assistance is listed in the updated Form 990 and Schedule I please click here.

-

How long do we keep records for donations to our nonprofit?

At least seven years after the donation. Many organizations keep them permanently but that is up to the organization.

-

When we pay someone a stipend do we have to give them a 1099 at the end of the year?

Yes you do as it is considered “non-employee compensation.” Please check out the IRS’s 1099-Misc information here.

-

Where can I find more sample policies and procedures? Specifically ones that the IRS is asking for?

updated Form 990 The Yolo Community Foundation has put theirs online to promote good governance, please check them out here.

Also the National Council of Nonprofits has some good samples as well. -

Do raffle and auction winners get a donation thank you?

Yes, if they end up paying more than market value for the item they recieved. Check out this nice piece from the IRS that is all about contributions and specifically take a look at the examples that start on page three.

Did I miss any? Ask them in the comments below or email me.