Today I just have a short round up of interesting items from the last few weeks. But I first want to say thanks to the Nonprofit Congress Blog for mentioning this blog in the Nonprofit Blog Carnival it recently hosted.

Today I just have a short round up of interesting items from the last few weeks. But I first want to say thanks to the Nonprofit Congress Blog for mentioning this blog in the Nonprofit Blog Carnival it recently hosted.

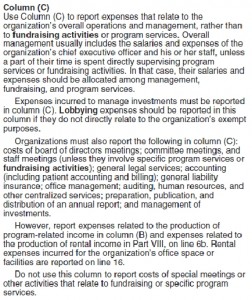

This piece is from mid May but it is worth another mention. The article is on administration costs and charity ratings from the Good Intentions Are Not Enough blog. The premise is that the focus on administrative costs can do harm than good, and I agree with the author’s arguments.

This article from the Nonprofit Professionals Advisory Group is a nice wrap up of the President’s Stimulus plan and its possible effects for the nonprofit sector. From helping organizations stay afloat to expanding others, there is a lot to know about the plan.

Our sector is not immune to questionable ethical decisions. This article from the Stanford Social Innovation Review highlights some of the issues specific to the nonprofit sector and ways to promote ethical behavior in charitable organizations.

When groups talk about saving money all options should be on the table. But eliminating Directors and Officers liability insurance is a risky option. This article gives some good reasons why you shouldn’t cut it and some tips about judging your own coverage or shopping for other coverage. Here is a good resource for D&O insurance and other organizational coverages.

Nonprofit Resources – Three helpful items

Have a question about a nonprofit issue?

BoardSource has a really nice Question and Answer section. Some of the items are member only but there is plenty of free information available. This site also has a bunch of Q&A’s here.

How does a nonprofit go out of business?

While there may be some state specific rules you’ll need to look up, the IRS recently published this piece on how to terminate an organization.

Private Inurement, Excess Compensation, Intermediate Sanctions, and Rebuttable Presumption

This free publication from GuideStar outlines what the IRS expects of charities and how we can comply with the rules that govern 501(c)(3) organizations.