As I consult with nonprofits in California, I have seen a theme emerge: A nonprofit’s accounting system may not have been put together in a thoughtful manner. I don’t mean this as a criticism to the people out there making a difference in their communities who work in nonprofits. I frequently ask in my trainings, “Who started working in the nonprofit sector because you like accounting and filling out reports?” In almost five years only one person (besides me) has ever raised their hand. We go into the sector because we care about the mission, making a difference, building community, or any other number of reasons. Not so we can crunch numbers.

As I consult with nonprofits in California, I have seen a theme emerge: A nonprofit’s accounting system may not have been put together in a thoughtful manner. I don’t mean this as a criticism to the people out there making a difference in their communities who work in nonprofits. I frequently ask in my trainings, “Who started working in the nonprofit sector because you like accounting and filling out reports?” In almost five years only one person (besides me) has ever raised their hand. We go into the sector because we care about the mission, making a difference, building community, or any other number of reasons. Not so we can crunch numbers.

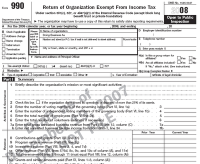

But some people are shocked when they realize just how much regulation, filing and paperwork comes with a tax exempt status. Nonprofits do not always grow their internal capacity, including the finance piece, at the same pace as they expand program and development. That is understandable as those two areas drive most nonprofit funding. But organizations who ignore their accounting systems do so at their own peril because at some point a Board member, a funder, or even the IRS will ask something like, “How much did we spend on this program?” Getting that answer — and the answers to other questions like, “How much did we spend of Funder A’s grant?” or, “What is the total cost of that program, including all of the allocable costs?” — largely depends on how well your accounting system is set up.